Investment

Therefore, in recent years, the Banking System has maintained a constant rate of investment in different areas, the most notable of which are real estate properties, systems, training, the development of new products and services ad advertising. These programs have generated a considerable demand for goods and services in various branches of economic activity.

The outlook for the country’s investments and growth are positive. Macroeconomic stability and the structural reforms have opened up important areas to investment, mainly in infrastructure and energy. The Banking System is currently well capitalized and in optimum conditions to assist and support the country’s economic growth.

It must be emphasized that in recent years, significant funds have been invested to provide banking services to population centers that for various reasons, did not have access to them. This process improves its possibilities or development through financing instruments, savings and means of payment.

The bank is aware of its responsibility in the economic development of the country and will therefore maintain constant investment to be able to offer more and better services at more competitive prices to a greater number of Mexicans.

Economic Benefit

The economic benefit that derives from the Banking System’s investments and activities has a relevant impact on a large number of goods and services manufacturers in different productive sectors.

As a consequence of the Banking System’s national coverage, the economic benefit has an impact on the country as a whole and strengthens multiple companies at local level, which represents a significant benefit.

The computer and communication systems, construction, machinery and equipment, as well as publicity, are the sectors affected most by the investments made by the Banking System for its own development and promotion.

Solidity: a responsibility and the opportunity to support growth

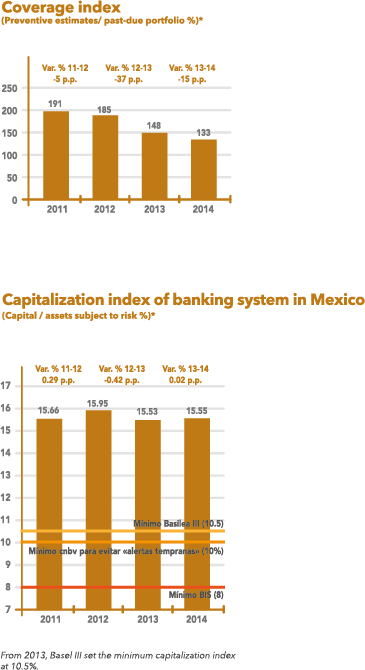

In recent years, the international financial system and the banking system in particular, have experienced problems of capitalization and coverage indexes. This panorama contrasts with the solidity of the Mexican Banking System, which has efficient risk analysis models, trained and experienced personnel and an adequate management of risks, as well as macro-economic stability.

Due to the high percentage levels of reserves with regard to the past-due portfolio, in recent years, the capitalization indexes of the Mexican Banking System have been above the parameters established by the National Banking and Securities Commission and several international standards, such as Basel III.

The Mexican Banking System shows solidity and is in a good position to finance the growth of the country responsibly and with a sustainable outlook.

Savings: a resource to maintain growth

Having positive savings rates is a condition that is necessary for the sound the financing of credit and economic growth. The Mexican Banking System has focused on encouraging savings through new instruments that enable accessibility, ease and better financial education.

It is important to emphasize the efforts made by the Mexican Banking System to drive popular savings. Specific products have been developed to serve the population close to their towns and offer terms, amounts and liquidity according to their needs.

Saving through the Banking System has shown a constant growth of more than 7% annually in recent years, which establishes a sound financing platform.