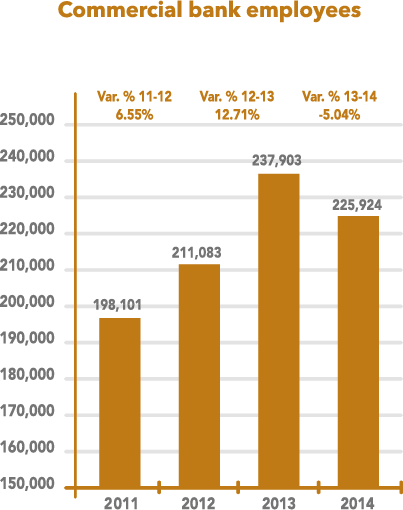

Employment

In recent years, employment in the banking sector has reflected a constant growth with an average rate of more than 218,000 employees in the last four years, who enjoy salaries and benefits well above the national average. More than 27,800 direct jobs have been created in the last four years.

Development of Human Capital

In a market ever more sophisticated in terms of products, services, system and standards, which, as with a highly competitive environment, having a better trained, motivated and committed human capital is a fundamental factor on competitiveness and an essential variable of the economic pillar of all banking institutions. Therefore, significant funds are invested in the selection, training and retention of talent.

The different banking institutions have training programs to increase the skills of their personnel in areas such as customer service, financial products and services, systems, electronic banking, data management, marketing, finances, sustainability, human rights and ethics. The institutions also offer courses in order to contribute to a more balanced life, focused on better co-existence and also offer training in regulatory, money laundering prevention and personal data protection issues. The institutions also have professional development programs that stimulate employees to take higher level studies, English and skills development.

Different media are used to achieve these training objectives, which include traditional methods and new methodologies and classroom and distance learning technologies.

Training in Human Rights

(G4-HR2) In the Banking System, we have implemented human rights policies and procedures in accordance with the United Nations’ Universal Human Rights Declaration. This includes the compliance with standards and codes of ethics, gender promotion, development and diversity plans, fair treatment and the correct use of information, including the management of personal data and the right to confidentiality.

In 2014, there was a total of 346,888 hours of training in human rights policies and procedures relevant to the operations of each institution.

Job Performance Evaluation

(G4-LA11) Job Performance Evaluations are other indicators to measure and manage employee satisfaction, They allow employees to identify their strengthens and opportunities to improve their performance and open up spaces for the institution to align the individual objectives with the objectives of the business and the work team.

The following table illustrates the percentage of employees who, based on their professional category and gender, are subject to a formal and regular performance evaluation process.

The evaluation processes are usually annual and are aligned to remuneration and promotion programs within the organizations, which generates an initiative for the personal and professional of each employee.

The different performance evaluation programs applied to the Banking System’s personnel include the 360 evaluation processes. These processes consider aspects that go beyond the mere achievement of goals, such as leadership, teamwork, communication and the living of values. The common objective is to achieve a comprehensive and harmonious development of the human capital