Credit to Drive Sustainable Development

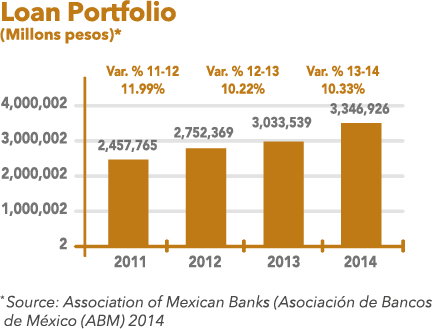

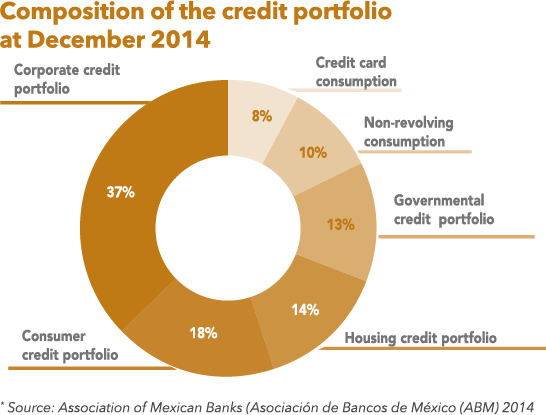

In the last year, the loan portfolio reflected an increase of 10.3%, a figure that contrasts with the growth of the GDP, of 2.1%. The demand for credit in the private sector originated in the corporate and housing sectors, with growth rates of 8.1% and 9.7%, respectively. Consumer credit reflected the lowest growth rate, with 6.0%. Finally, credit to the governmental sector showed an increase of 25.1%, although this only represents 13% of the total loan portfolio.

The increased demand for credit is the result of the growth expectations for 2015. Said expectations are the result of greater investment, the opportunities that arise from the structural reforms, particularly the energy and financial reforms, from the impetus to infrastructure products and the incipient resurgence of the housing sector.

The Mexican Banking System is ready and prepared to drive economic growth through the responsible expansion of credit.

Interest rates that drive growth

Macro-economic stability and a backdrop of high competition that characterize the Mexican Banking System, have fostered low interest rates. In turn, this translates into better savings and feasibility of projects to drive the growth of the country.

Interest rates in Mexico are at historic minimum levels. This is the result of the efficiency of the Mexican Banking System, competition, micro-economic stability and low international rates, particularly in the United States of America.

This low level of interest rates encourages the demand for credit, which results in better economic growth, lower costs, greater competition and an outlook of better well-being that has a positive impact on society as a whole.

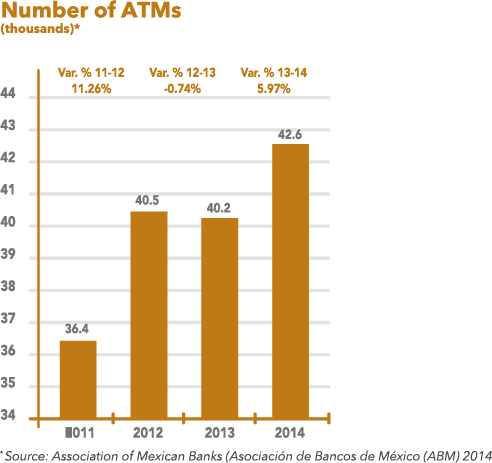

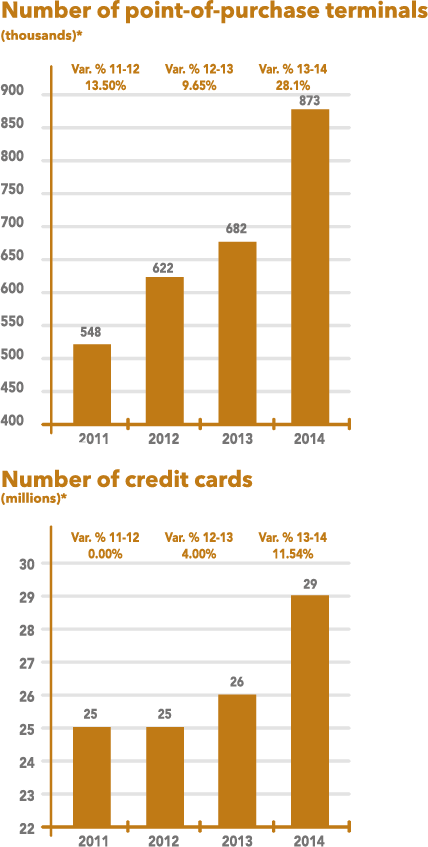

The banking infrastructure in Mexico grows every year in order to achieve better levels of access to banking services, provide more and better products and services and in general, improve customer service. This effort results in being closer to users, providing them with efficient transaction and payment means, meeting the needs of segments that previously did not use banking services, driving micro-credit and savings, particularly in the low-income sectors, and in general, expanding banking services.

Technology: economic, social and environmental efficiency

(FS 16) Technology is a competitive factor that has an impact on the three pillars of sustainability. In the economic sphere, it makes products and services more attractive by reducing costs and facilitating better service levels; in the social sphere, it encourages the use of new technologies, improves people’s quality of life, saves time, resources and offers greater security; and in the environmental sphere, it reduces the use of paper and other supplies and optimizes physical transfers, which results in lower carbon emissions.

Therefore, technological innovation is present in all the Mexican Banking System’s activities.

In 2014, the number of electronic transfers via the Internet increased by 7 million to reach 735 million transfers. 1.99 million transactions per day.

Better access to banking services benefits more Mexicans.

Our coverage increases daily through our correspondent banks by enabling a larger percentage of the population to gain access to banking services through a secure, accessible and nearby infrastructure, which provides them with the service experience of the highest quality in a familiar context.

The acceptance of correspondent banks has become evident by the accelerated growth in recent years. In 2014, 27,000 correspondent banks were operating in throughout Mexico.

It is important to emphasize that the opening of a correspondent bank results in several economic, social and environmental benefits, such as the training and development of new skills, increased value for customers, increased user traffic and, in summary, increased revenues.

For our customers, correspondent banks represent access to banking services, as well as savings in time, money and increased security. Taken as a whole, this saving translates into an environmental impact.

Correspondent banks are located in convenience stores, service offices and several other businesses, where they offer the following services:

• Opening savings accounts

• Receipt of deposits

• Payment of services

• Loan payments

• Cash withdrawals

Below is a summary of the most significant advantages of correspondent banking from the perspective of sustainability: