We are aware of the important role that the Mexican Banking System plays in the country's development. Through our various services, we fulfill the objective of promoting the use of banks and financial inclusion, extending credit and encouraging savings.

A competitive, agile and farther reaching Mexican Banking System is an important factor to drive the development of Mexico. Accordingly, we have invested to make our processes more efficient, expand the coverage of services, increase the range of products and offer our customers better prices in a market that is characterized by high levels of competition.

We understand development as a process which, through the generation of wealth, increases a population's levels of well-being in a comprehensive and balanced manner, in harmony with the preservation of the environment and the interests of society. In this vision, in the Mexican Banking System, we adopt technologies and implement processes that represent a lower environmental impact by investing human, financial and material resources to strengthen the social fabric of our country.

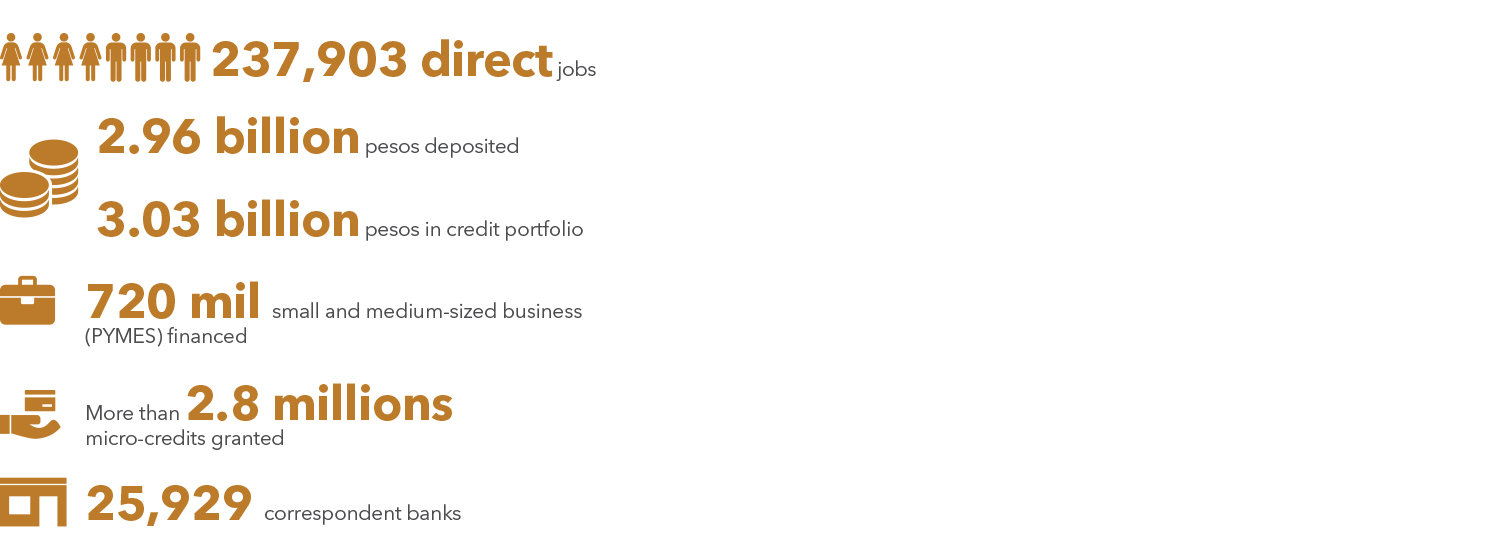

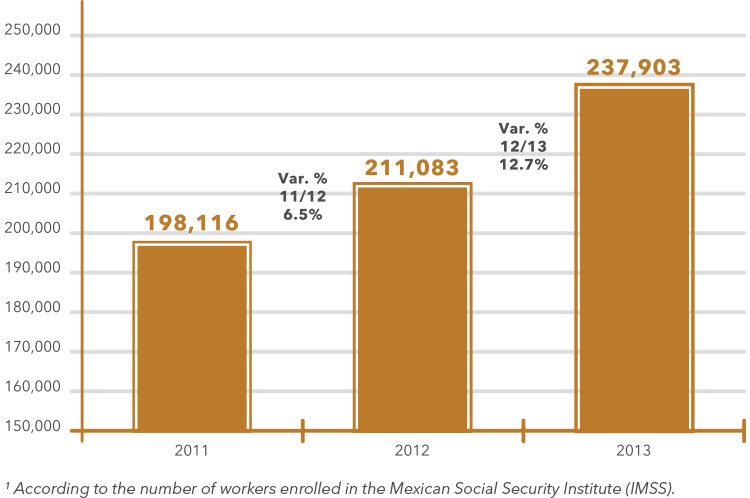

The Mexican Banking System has been consolidated as a generator of employment whose characteristics contribute significantly to social wellness.

Employment in the banking industry grown at a constant rate in recent years. A variation of 12.7 % was achieved in 2013; a figure far higher than the generation of employment in the country. 26,820 new jobs were created during the year, which represent 5.8% of the jobs generated in Mexico . If we consider the past three years, 73,080 direct jobs were created, which are equivalent to 4.1% of the total generated in the country.

The Banking System is a rapidly growing source of stable and well-paid jobs in Mexico.

Human capital is the most relevant variable of a Banking System that is both efficient and capable of providing the products and services that stimulate development.

New technologies, high levels of competition, the demand for more and better financial products and services, coupled with the need to be more competitive every day, require our country's banks to have the most highly trained, creative and efficient human capital. On being the key to sustainability, the Banking System maintains constant investments in order to update and develop the capabilities of its employees.

In terms of training, this year we focused our efforts on issues related to the prevention of money laundering, financial education, strengthening graduate programs and the use of new technologies for electronic banking, data management and customer service. It is important to highlight the investment in training to meet the requirements of the Federal Personal Data Protection Law.

The growing relevance - reflected in the number of programs and courses - of the overall development of all our employees should be noted. We recognize the importance of the balance between work and personal lives and of a holistic perspective that takes the person and their social environment as its focal point.

In the training processes, we use a wide range of media, which encompass both on-line and classroom education programs.

The skills and performance of our employees are evaluated on a constant and regular basis. In some institutions, methodologies are used where the fulfilment of goals is evaluated on a par with team work, communication among peers and the experience of institutional values, among others.

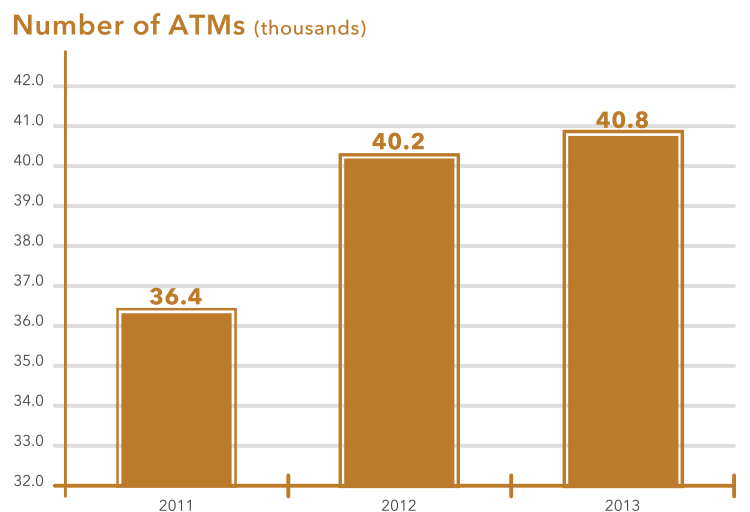

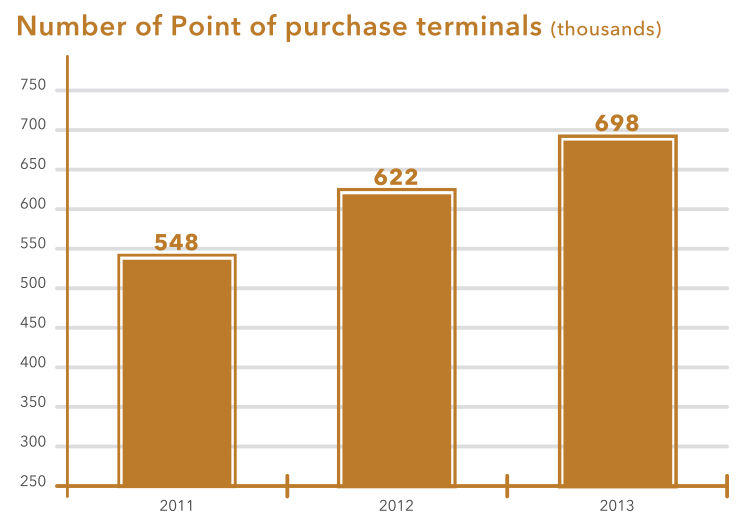

In order to ensure more efficient and competitive financial services, the Banking System makes constant investments to achieve greater coverage with a reduced use of supplies and resources. We are looking to reduce costs for users and generate a benefit for various sectors of the economy.

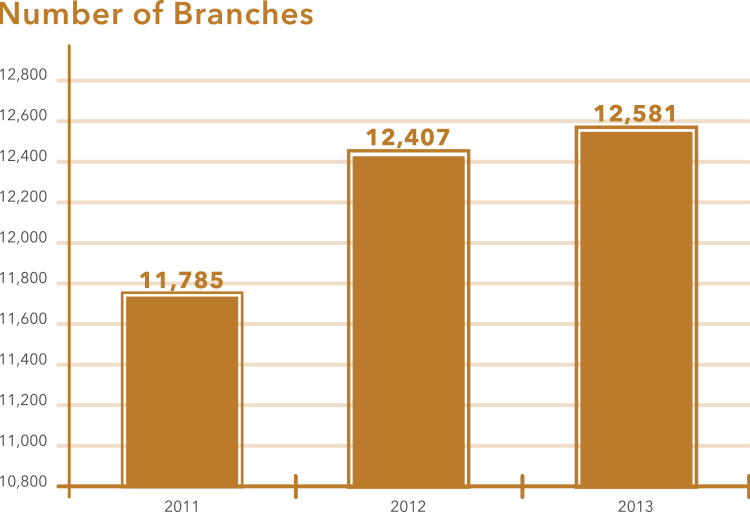

Although 2013 was characterized by lower economic growth, the Banking System maintained its rate of investment in infrastructure, systems, communication, training, administration and new technologies.

We are aware of our responsibility to promote the development of Mexico. The country is currently undergoing a key moment thanks to the structural reforms implemented by the State. This new stage should be characterized by increases in investment and an economy with higher growth rates. In the Banking System, we are well prepared to face the challenges of this economic situation.

Our investments are aimed at boosting economic development and creating opportunities for the well-being for a greater number of Mexicans. To achieve this goal, we are working on expanding our coverage through branches, correspondent banks, digital services and micro-credits, among other services. In addition, we are allocating substantial resources to financial education programs for the benefit of millions of people.

Constant investment, the increasing level of employment and the continued operation of the sector, demand a set of goods and services that foster a virtuous economic circle.

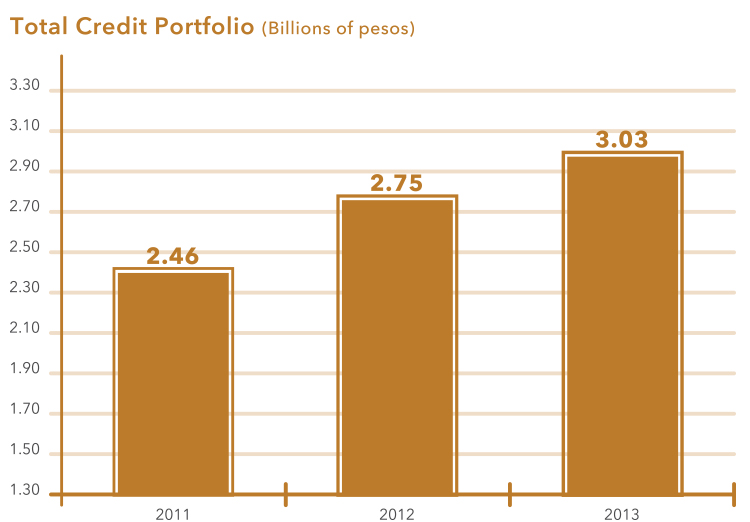

Savings and credit are the factors that have the greatest impact on economic development. During 2013, these items grew by 6% and 10%, respectively; far higher than the increase of the GDP in the same period.

In 2013, the sectors that benefited most by the growth of banking activities were:

• Construction

• Systems

• Communication

• Machinery and equipment

• Advertising

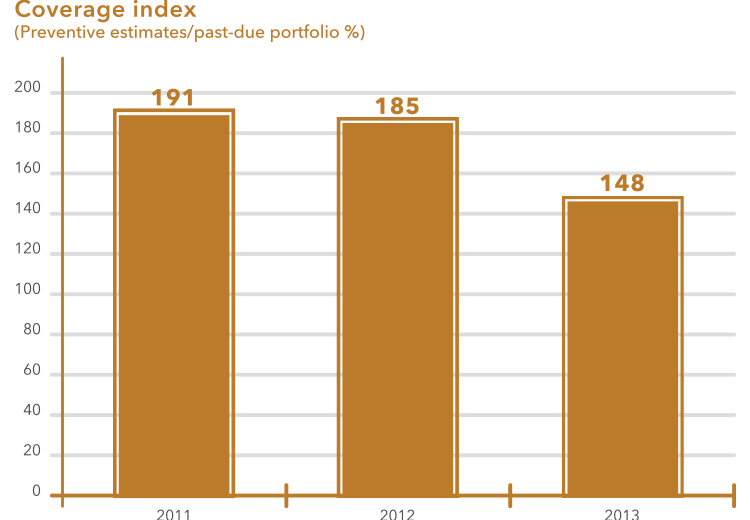

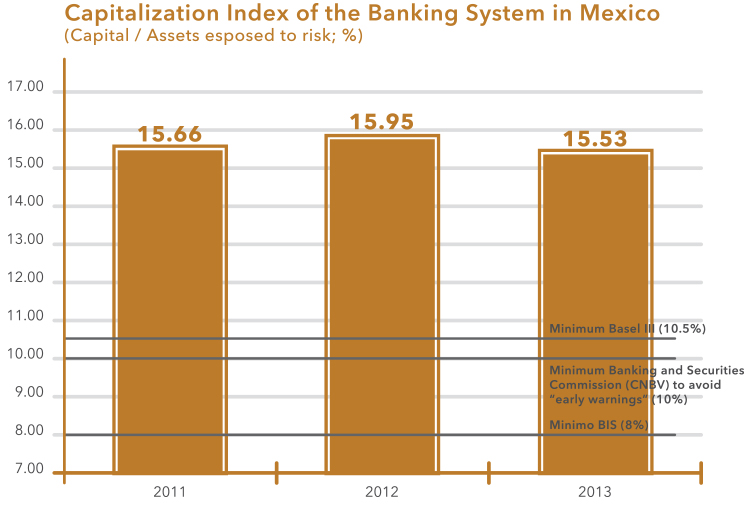

Today, the Mexican financial system has the strength necessary to grant credit responsibly and drive economic development with firm foundations.

The strength of the Mexican financial system is reflected in its rates of capitalization, which are above national parameters such as the National Banking and Securities Commission (CNBV) and international parameters such as Basel III, and for its high percentages of reserves for past-due portfolio.

The infrastructure of the financial sector, its experience and the creation of a more competitive regulatory framework provide a favorable scenario for the responsible expansion of credit with a long-term sustainable outlook.

Savings are essential in order to grow with solid foundations and achieve higher levels of well-being.

In the last few years, savings deposits through the Banking System showed growth rates of more than 6%. This figure compares favorably with the development of the economy and is an indicator of more and better instruments.

Through a sustained increase in the coverage of services and the implementation of various economic and financial education programs, we have promoted savings at all levels, particularly among the segments of the population with lower incomes or who live in areas of difficult access, which constitutes the initiation of a virtuous economic and social circle.

The recent structural reforms - including the financial reform - provide a scenario of greater economic growth, in which credit will play an important role as a development agent.

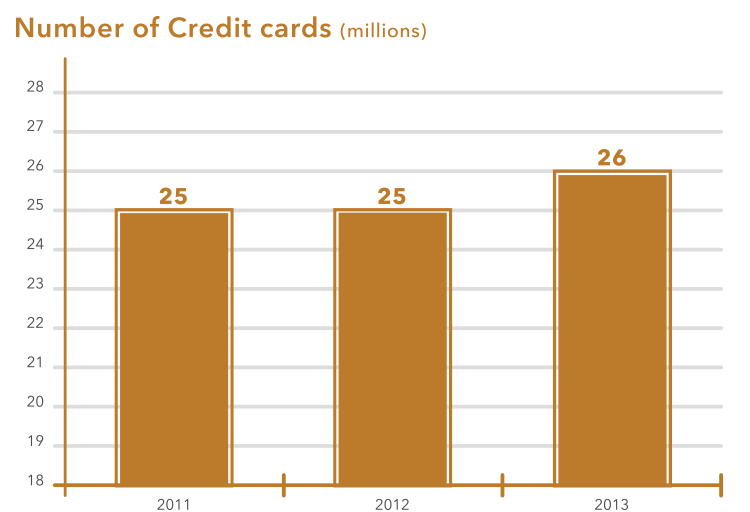

In 2013, credit reported a growth of 10%, a figure nearly four times higher than the GDP growth. This expansion had a greater impact in the housing sector and in the financing of small and medium-sized businesses through micro-credits.

Responsible financing of the economy is a vital factor to achieve long-term sustainable development. For this reason, we are incorporating environmental and social impact criteria into the granting of our credits, which guarantee certainty and effectiveness in the matter.

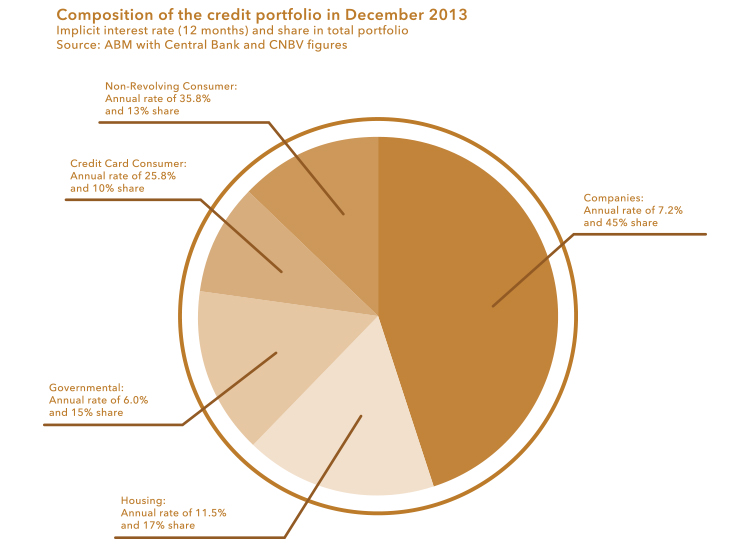

The downward trend in interest rates is a result of economic stability and a competitive environment that favors the Banking System's customers.

The reduction in interest rates in the different loan products has been a constant in recent years. This trend is the result of improved credit processes and analysis, as well as the country's economic stability and an atmosphere of high competition in the sector. The reduction in financial costs is even more evident in home, business and consumer loans.

Lower costs of money translate into competitiveness, growth and well-being, which lead to their positive social and economic impact.

Gracias a una fuerte inversión en capital humano, infraestructura, productos y canales, en los últimos años hemos contribuido a la rápida Bancarización del país. Hemos diseñado servicios que se ajustan a los requerimientos de nuestros usuarios, a sus patrones de ahorro y necesidades de financiamiento. Hemos extendido la cobertura de microcréditos, así como el apoyo a pequeñas y medianas empresas. Adicionalmente, hemos extendido los medios Bancarios de pago, propiciando el ahorro en segmentos populares.

The use of more modern technology and efficient translates into growth, savings and competitiveness. Today, we have the ability to transform information into intelligence, efficiency and knowledge, which allows us to drive the sustainability of the sector.

Technology is a central component of nearly all products and processes. In addition to the developments in electronic banking infrastructure and coverage, technology allows us the efficient management of market information for decision-making and credit analysis purposes, as well as providing better customer service in terms of accessibility, speed and convenience. To these advantages, we can add paper and energy savings programs, which strengthen the sector's sustainability and provide social, economic and environmental benefits.

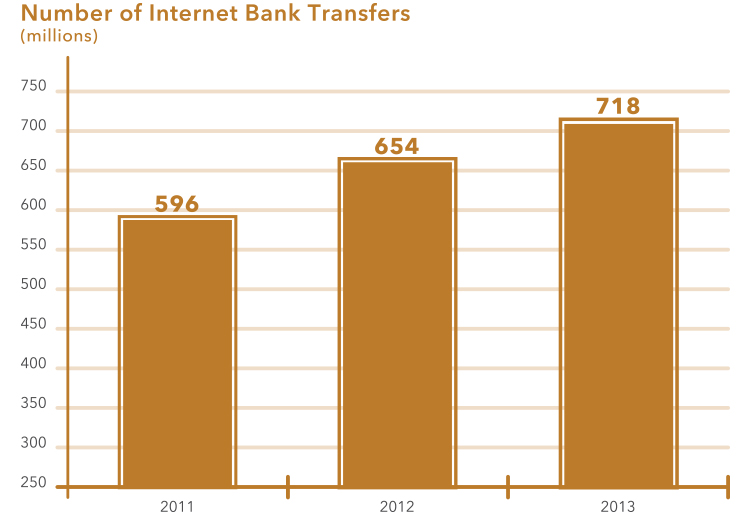

In 2013, the number of electronic transfers via the internet increased by 10% compared to the prior year. This figure is equivalent to 718 million transactions (81,963 transfers per hour).

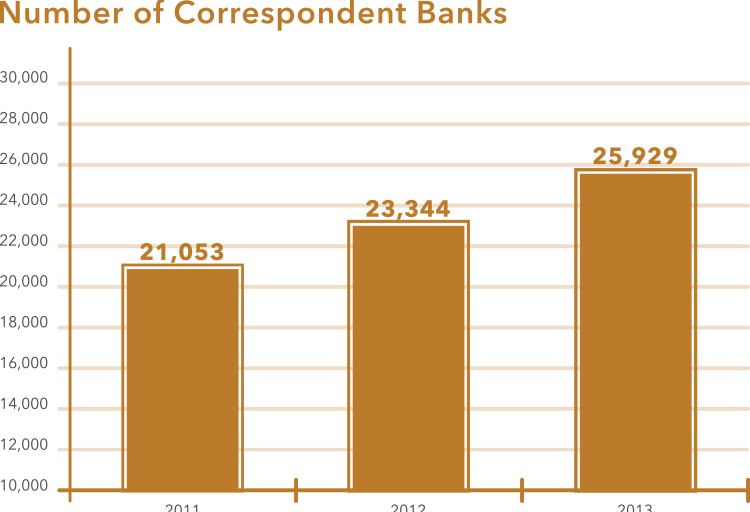

The expansion of our correspondent bank network has allowed us to extend coverage to all sectors of the population.

By the end of 2013, there were 25,929 correspondent banks; an increase of 11% compared to 2012.

The increase is due to economic expediency, as the use of pre-existing infrastructure translates into better services for our customers.

Through this program, local businesses, service offices and commercial channels are transformed into centers where users can perform banking transactions, such as:

• Opening savings accounts

• Receipt of deposits

• Payment of services

• Loan payments

• Cash withdrawals

The opening of these correspondent banks involves training of a large number of people and the consequent development of skills and knowledge allows them to diversify their sources of income.

Moreover, our customers benefit from access to various financial services which, due to their characteristics, translate into savings in transport, increased security, time savings and many other advantages.

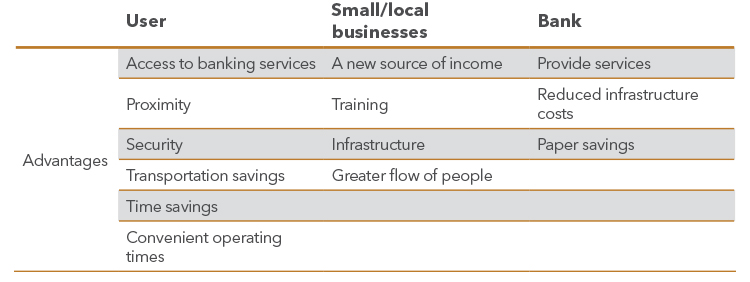

Below is a summary of the most significant advantages of correspondent banking from the perspective of sustainability: