SUPPORTING THE

COMMUNITY

We train our employees and foster their development, recognizing and encouraging their efforts and dedication.

Through programs that foster conditions favorable to development, such as recreational and sporting activities, the banking sector in Mexico has helped to create healthy workplaces where employees can strike a balance between aspects of their professional and personal lives. Days are set aside for visits by children and family members of employees to the institutions and volunteer events and programs are organized which include the participation of friends and relatives of banking sector employees.

Our Employees

The employees of the banking system receive benefits superior to those required by law and the banking institutions offer retirement plans, preferential loan terms, free transportation, lunchroom services, and nutritional guidance, among other perks. Motivational campaigns are constantly organized to improve performance and fully integrate our personnel. This finally results in the more successful achievement of institutional goals and objectives.

Quality of Life in the Company

Professionalization

Constant training helps to promote a balance between human and economic development. In order to foster the professionalization of its personnel, the banking system supports in various ways the participation of its employees in educational programs both in Mexico and abroad. On occasion, study leave is granted to employees along with guarantees that they will keep their jobs or even be promoted.

There is a also a range of scholarships and financing (from 50% to 100%) for post-graduate studies (master's degrees and PhDs) or diplomas in subjects related to finance and banking services. Support is also given for improving specific skills, such as languages, computer use, and other aspects of human development.

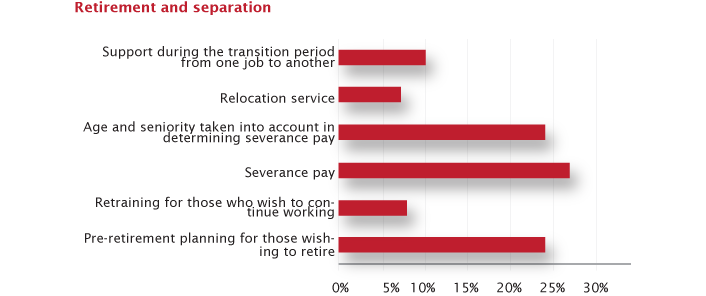

Retirement and Severance

Programs to support employees who are retiring or leaving the institution for some other reason include the following:

Diversity and Inclusion

The banking sector has implemented a range of diversity indicators, policies, and procedures to achieve a culture of inclusiveness and respect for differences that enriches our institutions. These include:

Indicators

·Gender

·Nationality

·Age

·Disability

·Minorities

Policies

·Human rights

·Diversity in hiring

·Promotions and transfers

·Minority groups

·Hiring of people with disabilities

·Incidents, layoffs, and returns

Procedures

·Support for minority groups

·"Institution Committed to Inclusion" Guide

·Internal diversity campaigns

In order to progress in the area of inclusiveness, in 2012 the ABM signed an agreement with the National Council to Prevent Discrimination that lays down a series of commitments in order to deal with issues of diversity and inclusion. These include promoting and implementing education, training, and awareness programs to avoid discriminatory practices and the joint design and coordination of training workshops and courses aimed at employees of the banking system.

Also, programs have been put in place for the inclusion of persons of visual or motor disabilities, reinforced by awareness campaigns within the institutions.

As part of these procedures, all banking institutions grant maternity and paternity leave. The rate of employee reincorporation varies, depending on gender, from 66% to 100%

Human Rights

Training

Institutions in the banking sector have made an effort to raise awareness among their employees of human rights, diversity, inclusion, and the avoidance of prejudice. In some cases, training is also extended to suppliers and potential customers.

At all levels, the institutions offer training in anti-corruption policies and procedures.

Policies and Procedures

Ever more policies have been drawn up and every precaution is taken to ensure that they adhere to the Universal Declaration of Human Rights of the United Nations. These policies are designed to eliminate difference in treatment in the recruiting, selection, and hiring of personnel on the basis of gender, social condition, ethnic origin, race, religion, or political opinions, among other criteria. Another fundamental aspect is to verify the age of applicants in order to avoid the hiring of minors.

These policies also deal with other issues, including:

·Compliance with laws, standards, and regulations

·Compliance with ethics and conduct codes

·Fair dealings and competition

·Use of information

·Customer confidentiality

·Security personnel

Complaints

A growing number of banking institutions have implemented lines for the internal reporting of complaints of fraud and other illicit activities. Contact is anonymous and the lines are administered in some cases by external suppliers. The aim is to guarantee complete confidentiality so that employees can report any irregularity.

Some institutions have an Employee Ombudsperson. This figure contributes to ensuring a climate of respect, ethics, collaboration, transparency, and equity among the personnel. This channel of communication also allows employees to work together to find more objective solutions to problems and to visualize situations from other points of view.

Sustainability in Banking Operations

A third of the institutions in the sector have already incorporated sustainability criteria in their investment analyses and a fourth part taken these criteria into account in granting loans.

Suppliers

The number of banks that include criteria or clauses related to the protection of human rights in their supplier contracts has increased. This improves relations all along the value chain, diminishing social and environmental costs and risks. In 2012, one quarter of the institutions in the sector had signed contracts of this kind and there were no cases of failure to comply with these clauses.

Community Support

P$2.7 billion invested in social projects

17.89 million people benefitted

163,874 students and teachers supported by the Bécalos scholarship program

3.4 million beneficiaries of financial education

Since their founding, our banking institutions have contributed to improving the living conditions of the Mexico's neediest populations. This support has been provided through the participation of employees, bank customers, and the general public. A part of the funds obtained by means of collection campaigns in automatic tellers and through deposits in bank accounts are channeled to this end, matched by contributions from the institutions themselves. The total amount is delivered to beneficiaries through civil society organizations. The principal area that receives support is education, at all levels. Some of the programs implemented in 2012 were:

"Just Raise Your Hand"

This program was carried out in alliance with Fundación Lazos. Its purpose is to improve the quality of education in primary schools, so that the children benefitted can achieve their maximum potential. It also seeks to transform school communities, fostering positive values and attitudes in children and young people in order to open up opportunities for their development that will create a better future for them and improve the quality of life of their families.

"Those Who Stay Behind" Integration Scholarship Program

Implemented in 159 municipalities in 20 different states, this program provides economic aid that allows beneficiaries to continue their secondary school studies. It also contributes to the comprehensive development of students by helping them set both personal and educational goals. It consists of two parts:

1. Monthly economic assistance of P$1,000.00 provided for three years.

2. Tutoring by branch executives as part of a corporate volunteer program.

"For the Children of Mexico" Trust Fund

For more than 19 years, the "For the Children of Mexico" Trust Fund has assisted the activities of social organizations dedicated to promoting the comprehensive development of Mexican children in disadvantaged social conditions. Its mission is to provide economic aid, counseling, and training for a certain time period to organizations legally established in Mexico that have been selected beforehand. It goal is the care, nourishment, and development of Mexico's children. This initiative has three main facets:

·Education

·Nutrition

·Health

In 2012, a total of P$7,075,000 in donations was channeled to 69 different organizations, to the benefit of 13,058 children. These donations were made possible thanks to the voluntary contributions of 8,411 employees, who also donated 2,026 hours of their time. Of the funds raised, 55% went to health projects for Mexican children between the ages of six and ten. A social projects workshop was also organized, with the participation of 89 organizations across Mexico.

UNICEF

The UNICEF "All Children to School" program seeks to ensure universal access to quality basic education. In 2012, a total of P$2,437,219 was raised, of which 15% went to the "For the Children of Mexico" Trust Fund and the remaining 85% to UNICEF. The funds were distributed in the following way: for the "All Children to School" initiative, 25,5% went to Chiapas, 17.5% to Yucatán, and 32% to Zacatecas. The remaining 25% was channeled into the Fifth UNICEF Prize.

Another initiative is the Nominal System of Out-of-School Children, which helps to identify children who are not in school or are registered at a level not in keeping with their ages. In 2012, thanks to the program, 5,389 children were registered in schools in Chiapas, Yucatán, and Zacatecas. Additionally, 476 teachers were trained so they could learn about the system.

"Children's Knowledge Olympics" Scholarship

These grants are provided to sixth-grade students who win the "Children's Knowledge Olympics" organized by the Secretariat of Education. A national competition, it consists of three stages of exams in the six main primary school subject areas: mathematics, Spanish, geography, history, natural sciences, and civics.

Each of the one thousand winners receives a 1,000-pesos scholarship granted for the ten months of the school year, which can be extended through the three years of secondary school, providing the student maintains an average of 8.5 (in the case of rural or indigenous schools) or 9.0 (in the case of urban or private schools).

Universities Program

This corporate social responsibility program is designed to support higher education. The main results of the program in 2012 were:

·1,469 scholarships awarded through academic mobility collaboration agreements.

·The "TOP Brazil" Scholarship Program, through which 40 Mexican students and professors spent

·Design of the FIMPES grant program in conjunction with the Federación de Instituciones Mexicanas

·Program whereby Mexican university students participated in workshops given in prestigious

·The "New Entrepreneurs" program offered training internships for university students in various

·Support for more than 15 universities through donations amounting to more than P$13 million, as

·Signing of 160 collaborative agreements with the Universidad Autónoma de Sinaloa (renewal), the

Universia

Universia was established in Mexico as a social enterprise focused on providing tools and assistance to universities and companies that support the development of the academic and business sectors. It generates collaborative projects that contribute to the development of Mexico. The Board of Directors of Universia is made up of the deans of Mexico's major universities.

In Mexico, since 2012, Universia has linked up 2,567,216 students and 271,212 professors through its collaborative support network, which is linked in turn to 160 higher education institutions all over the country, representing 60% of the university sector.

In the aim of contributing to the development of science and technology in Mexico, Universia supports various publications:

·Special edition of the magazine Líderes Mexicanos: "Los líderes universitarios proponen."

·The book Ciencia e Innovación en México: cuatro grandes proyectos científicos, in conjunction with

Also, support was given to 185 senior officers from 138 different universities so that they could participate in international seminars in the following subject areas:

·Young people in Mexico

·Professional skills of university and pre-university students

·Survey on university students' perception of Mexico and its state governments

Community Development

Educational and Productive Centers

These centers were created to improve the quality of life and support family and personal development, especially for women and children, in Mexico's poorer communities. They offer courses and activities all over Mexico in three subject areas:

- Education

- Incubation of micro-enterprises

- Transfer of knowledge for social development

In 2012, this low-income housing program raised P$4,553,965, channeled into the construction of 364 houses to the benefit of the same number of families.

Natural Disaster Aid

This assistance consisted of the distribution to needy populations of food, clothing, blankets, medicines, and household articles, through the Mexican Red Cross and the local DIF family services agencies. On some occasions, funds were allocated to repair infrastructure such as damaged schools or to rebuild homes.

In 2012 several states in Mexico were seriously affected by drought. In response to this situation, funds were channeled to communities in Chihuahua, Durango, San Luis Potosí, Coahuila, and Zacatecas.

Foundations

Through the foundations of banking institutions, charitable projects in support of a wide range of causes were carried out: education programs, environmental awareness, community development, support of the disabled, social assistance, human rights, health care, and cultural initiatives.

One example is the Fundación… Apoya, which channeled resources into education, health care, and the environment. In order to receive aid, organizations must have been in operation for at least three years and submit progress reports. Analysis determines whether the projects are viable in the long term.

In 2012, the foundation supported programs to help children with cancer and girls in risk of working and living on the street. In the area of environmental awareness, workshops were given to employees of banking institutions and their families.

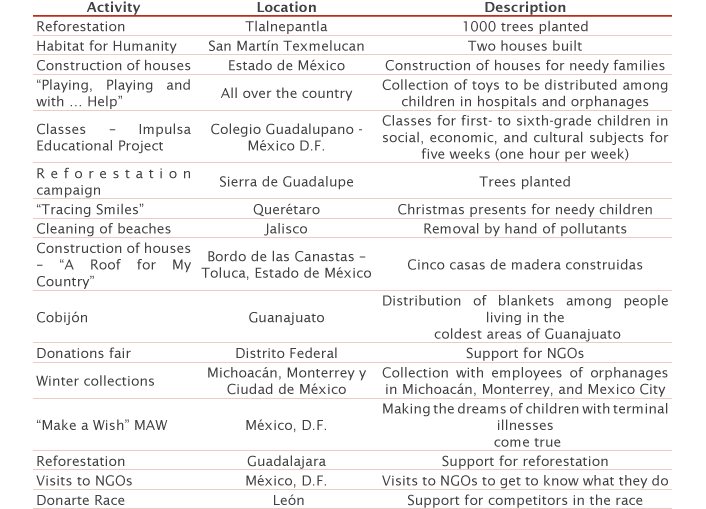

Volunteer Work

As part of our activities on behalf of local communities, corporate volunteer programs have been established, whereby employees of the banking sector contribute to improving the quality of life of the communities where they work. Participation by friends, family members, and even customers and suppliers is also encouraged.

In 2012, the following were some of the activities undertaken:

Impact Evaluation

Projects have been carried out to gauge the impact on needy communities of the construction of houses and the strengthening of productive capacities. In 2012 there were no cases of negative impact in communities where the banking system is present.

Alliances

In order to carry out their projects in 2012, banking institutions struck alliances with various civil society organizations, governmental agencies, and universities, including the following:

| ·Fundación Comunitaria del Bajío ·Ashoka ·Instituto Nuevo Amanecer ·Grupo de los Dieciséis ·Un Techo para mi País ·Universidad Anáhuac ·Inroads ·Make a Wish ·JEMAC ·Deporte-es ·Cáritas ·En nuestras manos ·Cruz Roja Mexicana ·Ciudad de los Niños ·Fundación Gruma ·Fundación IMSS ·SumaRSE ·CASA-Escuela de Parteras Profesionales ·FIRST ·Centeotl, A.C. ·Fundación Merced ·Fundación ProEmpleo Productivo ·YMCA ·Confederación Mexicana de Organizaciones en |

·Unidos lo lograremos ·UNAM ·Fundación Marillac ·Olimpiadas especiales de México ·Machincuepa Circo Social ·Taller leñateros ·Naturalia ·Comité para la conservación de especies ·Los ojos de Dios ·Centro para los adolescentes de San Miguel de ·Asociación Mexicana para la Audición ·Ayúdanos a oír ·AMANNC Querétaro ·Ojos que sienten ·Sanando Heridas ·Asociación Mexicana para la Superación Integral ·Casa Cuna La Paz ·Fundación San Ignacio de Loyola ·Fundación Rebeca de Alba ·Fondo para niños de México ·Servicios Educativos del Bajío ·Fundación Cim*ab ·Fundación Kardias |

Cultural Promotion

This is another project undertaken by banking institutions, in the aim of supporting different kinds of artistic expression and the artistic traditions of local communities through sponsorship, the promotion of exhibitions, support for publications, and activities organized in cultural spaces.

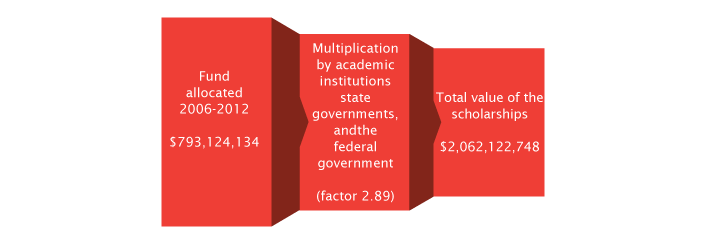

28 banks and financial institutions

21 companies and organizations

Secretaría de Educación Pública

32 state education secretariats

102 academic institutions

Seven years since it was founded, the Bécalos scholarship program, result of an alliance between the Asociación de Bancos de México, Fundación Televisa, and banking institutions, supported by their customers, is the largest donor of grants and financial aid in the private sector. Those benefitted by the program now number 74,169 primary school, high school, and university students and 89,705 teachers and administrators.

Banks

Friends of Bécalos

Participating Institutions

Bécalos offers the following grants and scholarships:

·Full-cycle scholarships for high school and university students demonstrating academic excellence.

·Scholarships for technical and scientific studies that contribute to the development of Mexico.

·Training programs for public school teachers and administrators.

In addition to awarding scholarships, this program is an important support for students working to achieve their academic goals. In 2012, the Bécalos Community was created, a place where students can find tools to strengthen their academic skills and enter the workforce following their studies. Through social networking, contact is established and maintained with other recipients and former recipients of scholarships. This all makes for quality education and a greater number of success stories.

Also, financial education courses were offered to more than 8,180 teachers and school administrators.

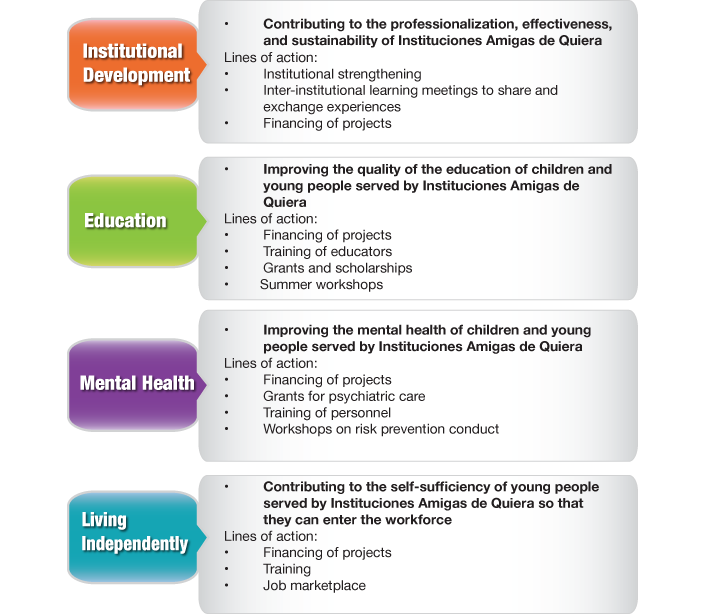

This foundation is a non-profit organization that works in conjunction with other institutions to create safe, violence-free spaces for children and young people at risk of living and working on the street, giving them the opportunity to rewrite their stories and fill them with possibilities.

The organizations supported are called "Institutional Friends of Quiera" (Instituciones Amigas de Quiera, or IAQ) and make up IAQ networks. Fundación Quiera is currently present in 17 states in Mexico through 70 different IAQs.

The four lines of action of the foundation are:

2012 Results

Institutional Development

Thanks to the strength of its institutions, 14,035 children and young people have been benefitted

·IAQs supported 31 projects.

·Two inter-institutional meetings for 80 IAQs were organized.

·A model for the social prevention of delinquency was presented to teenagers in the context of the

·Two articles were published in Rayuela: Revista Iberoamericana sobre la Niñez and Juventud en Lucha

Education

A total of 5,596 children and young people were benefitted

·Seven educational projects were supported.

·4,214 summer projects were benefitted.

·Thanks to educational grants, 14 teachers were trained.

·The Quiera job marketplace had four beneficiaries.

·The vocational orientation workshops attracted the participation of 52 young people, 60% of whom

Mental Health

Support for 2,834 children and young people

·Through training and therapeutic care, 35 institutions were benefitted.

·28 children received support through grants for psychiatric care.

·In order to improve the mental health areas of IAQs and to hire psychologists to provide attention to

·The diagnosis and treatment of 344 children and young people for post-traumatic stress disorder

·101 psychologists and educators were trained in the use of new therapeutic tools such as narrative

·The mental health areas of seven institutions were systematized and equipped with procedure

·Therapeutic care with more than 100 families was enhanced.

·An alliance was struck with the Fundación Gonzalo Arronte, I.A.P. to design a project for the

·935 people were benefitted by violence prevention.

Vida Independiente

·Five young people were trained in professional marketing

·The job marketplace served four young people, two of whom entered the workforce.

Banking institutions are co-responsible in a fundamental aspect of the wellbeing of Mexico: financial education

Many employees of the banking sector voluntarily offer their time to provide other people with training. Among the programs offered:

Actions by the Financial Education Committee

The Financial Education Committee, in collaboration with various private and public institutions and universities, undertook to promote financial education and make it more widely available. The following are some of the activities organized in 2012 by the Financial Education Committee.

Children's Saving Day

This sector-wide activity was organized to include financial content in the formal education of Mexican children. Three years ago, the Committee decided to undertake a pilot project to serve as a platform for future actions carried out in conjunction with the Mexican Secretariat of Education. In 2010, Children's Saving Day was launched as an exercise in public schools in the city of Querétaro. With wider coverage of cities and schools and the participation of volunteers and banking institutions, the Day is now a successful reality.

With the support of educational authorities in the cities of Colima, La Paz, Hermosillo, Pachuca, and Querétaro, Children's Saving Day was celebrated on November 7, 2012. The aim of the program is to foster a culture of saving among primary school children by giving them basic information about the subject. The children learn to manage their own savings and set financial goals. In the third annual celebration of the children's saving day more than 700 volunteers from 17 banking institutions participated.

In total, 449 public schools and almost 750 groups of morning schedule fifth-graders from five different states were benefitted, representing a total of more than 28,500 students in a single day. The feedback received from the volunteers was very positive: almost all the participants agreed that the experience was positive and expressed their interest in participating again.

University Banking Congresses

For eight years now, the University Banking Congresses have been organized as specialized forums where representatives of banking institutions can interact with outstanding students from both public and private universities. The aim of the congresses is for the bank executives to share their experience and knowledge about the development and trends of the banking sector in Mexico.

The lecturers are members of the Financial Education Committee of the ABM or representatives of allied institutions such as Condusef, Amafore, Banco de México, the Mexican Stock Exchange, IPAB, Buró de Crédito, Mastercard, Visa, and Consar.

In 2012, more than 2,500 students enjoyed the benefits of the seven congresses organized. The subject was "Financial Education: Its Importance in Your Life and Future." Three of the congresses were held in Mexico City and the other four in different states in Mexico.

National Financial Education Week 2012

From October 1 to 7, 2012, the fifth edition of National Financial Education was celebrated, with the active participation of the banking sector. The goals of the event were successfully achieved: providing information, promoting the proper use of financial products and services, and teaching the general public how to make better use of financial resources. Some of the subjects addressed included family budgets, savings and investment, pensions, credit, and insurance.

In addition to the activities of each institution, on Thursday, October 4th, the work of the International Forum on Financial Inclusion and Education began, organized by Child & Youth Finance International in collaboration with the Secretariat of Finance, Condusef, Banco de México, and the ABM, among other institutions.

More than 150 participants from 19 countries in the region met in the Salón Hispanoamericano of the Secretariat of Education to share and exchange experiences, ideas, and better practices for educating children and young people and including them in the financial system.

Saber Cuenta

Las instituciones bancarias son corresponsables de un aspecto fundamental del bienestar del país: la educación financiera.

Saber Cuenta is an independent financial education program of the business area which does not promote financial products or services. Its mission is to create a financial culture that fosters quality of life for individuals, families, communities, companies, and institutions through the design, instrumentation, and evaluation of educational strategies about the generation, administration, and optimization of financial resources. It seeks to develop knowledge, skills, attitudes, and values related to the handling of personal finances in a prudent and informed way.

The program is offered free of charge to the general public, whether bank customers or not. Participating in the project are sixty partners from the public, social, and private sectors, who develop educational strategies independently of banking products and services.

"Adelante con tu Futuro"

With 20 stationary classrooms in 14 cities and 30 mobile classrooms, as well as through the website www.adelantecontufuturo.com.mx, more than 400,000 people have been trained.

"Adelante con tu futuro" is a social initiative whose mission is to empower users of financial services through basic financial skills.

A joint effort by specialists from the banking sector, who brought their knowledge and experience, and the Museo Interactivo de Economía (MIDE), which supplied the pedagogical framework, the program consists of workshops on the use of financial services on behalf of the general public.

In order to make proper use of financial services, a complete educational process is essential. It is necessary to go from "being aware" to "knowing" but also from "knowing" to "knowing how." In other words, people must be helped not only to understand what is important to enhancing their financial culture, but also to acquire the knowledge and skills to be able to use savings and credit on their own behalf.

Financial Education for Micro-Enterprises

The goal is to generate financial skills and knowledge within the family, empowering people to make sound financial decisions and so improve their quality of life

The program promotes financial knowledge through two strategies:

1.Training.

This is aimed at different audiences and seeks to change their financial behavior. In 2012 a total of 307,582 people were benefitted through various initiatives.

2.Awarenessa. An alliance with "On With Your Future," which benefitted 12,022 employees through

savings and loan workshops.

b. A workshop entitled "Improving My Personal Finances" designed to prevent over-

indebtedness, improve the

handling of resources, and foster savings. It was given to

1,580 employees.

c. "Entrepreneurs" is a course that promotes business culture. In 2012, 168 employee

volunteers trained a total of 4,124 customers.

d. Through the lecture "Responsible Decisions, Women Winners," the Committee Encounter

raised awareness among 91,851 women customers.

e.Adventures is a theater play whose goal is to send a message about the importance of

saving and caring for the environment. It was performed for 133,465 students of public

primary schools in 2012.

f. Aimed at teenage audiences, the lecture "Life Plans and Financial Education" raises

awareness of the importance of having a life plan equipped with the tools of budgeting

and saving. It was given to 64,540 public secondary school students.

The printed and digital media are fundamental channels of communication for spreading awareness of concepts of financial education, as well as a means of providing everyday financial advice to customers, employees, and the community in general. More than three million people were reached through these media.

Aflatoun

Seventeen years ago in India a program was created to foster the ethical use of financial resources, directed at children between the ages of six and fourteen.

In Aflatoun, the children themselves become the center of the learning process, increasing through play their personal autonomy, their knowledge, and their healthy self-esteem, all fundamental elements in the construction of a solid future for themselves. The program seeks to turn children into agents of change in their own lives and communities.

"Beyond Money"

This program is directed at fifth- and sixth-grade students. It teaches the importance of properly administering money in order to make informed decisions. It has been given by 80 volunteers to 40 groups in 12 different cities, reaching a total of 1,200 schoolchildren.

Bursanet

This financial education method simulates the buying and selling of actions listed on the Mexican Stock Exchange, in the aim of generating greater knowledge of the financial markets in Mexico. It stimulates the entrepreneurial spirit, fosters personal development, and helps participants to understand the financial markets.

Alianzas

| ·MIDE ·Banco de México ·Universidad Anáhuac ·Universidad Iberoamericana (Mexico City ·CONDUSEF ·ICEL |

·ITAM ·Instituto Tecnológico y de Estudios Superiores ·Escuela Bancaria y Comercial (Reforma campus ·Universidad de La Salle Bajío ·UPIICSA del Instituto Politécnico Nacional |

Other Activities

One banking institution, in alliance with the Universidad del Valle de México (UVM), developed an online course in "Personal Finances." Included as part of the Financial and Banking Businesses and the Public Accounting and Finances programs, the course has been promoted as an elective for students in any program at the UVM.

Educación Financiera para México (Financial Education for Mexico) is a publication of the Corporate Responsibility division of one of the banking institutions. Its aim is to present the initiatives undertaken by public and private institutions that promote financial education in Mexico.

The comic book Vengadores: Salvar el día (Avengers: Save the Day) is aimed at children so that they can learn concepts such as saving, spending, and budgeting in a fun and enjoyable manner.

In collaboration with the Fundación Cultural de Finanzas para Niños, A.C., dynamic courses that include games and recreational activities are given to children, so that they can learn about subjects such as the origin and function of money, the banking system, and the importance of saving in a fun and playful manner.

One of the banking institutions offered a financial education workshop directed at children and young people. During 39 sessions, a total of 790 students from Mexico City, Estado de México, Tlaxcala, and Hidalgo participated. Also, 12 lectures were delivered in six different universities, as well as 41 classes to fifth-grade students in primary schools in the Bajío region.

Children of all different ages attended the summer course on financial education. Financial concepts were explained through games and play so that the children could better absorb the information.