ABOUT THIS

REPORT

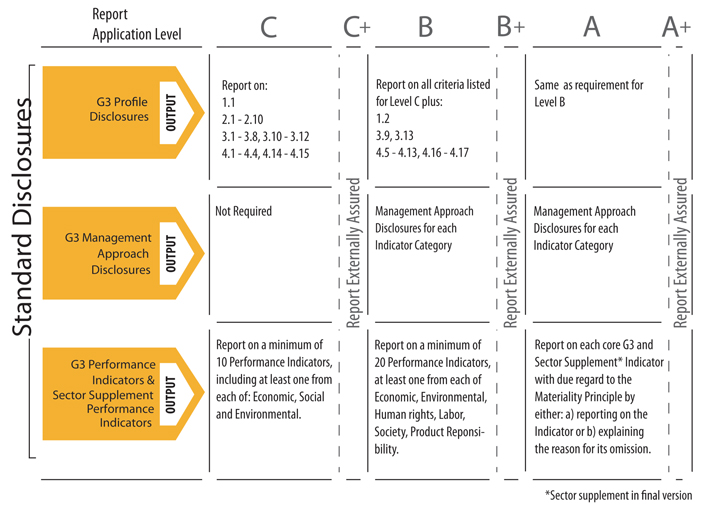

The 2012 Social Responsibility and Sustainability Report of the Mexican banking sector presents the results of the economic, social, and environmental actions and programs undertaken from January to December of 2012. For the fourth year in a row, the report follows the version 3.1 of the guidelines for sustainability reports of the Global Reporting Initiative (GRI).

In order to determine content, a materiality analysis was performed on the basis of relevant public affairs and the expectations and concerns of the various stakeholder groups of the banks belonging to the Asociación de Bancos de México. Information was gathered through interviews, the review of documents, and the data of the OptimumCSR System.

In the analysis of materiality, determination of content, and drafting of the report, then ABM was assisted by McBride SustainAbility.

GRI Index

VIEW PDF

Level of Application

We believe our level of application corresponds to a B.

Glossary

ABM Asociación de Bancos de México

Banxico Banco de México

BIS Bank for International Settlements

Buró de Crédito Private company constituted as a credit information company, designed to integrate and provide information prior to the granting of credit and during the term of the financing

Capitalization Operation consisting of adding interest to capital. Capitalization of liabilities refers to the process of creditors buying into a company by paying in capital through the liabilities in their favor

Capitalization Ratio Coefficient that represents the financial solidity of an institution against unexpected losses due to the risks it has incurred. It is calculated by dividing net equity by assets weighted by their risk level (market, credit, and operating)

Capturing The capturing of resources from the public in the domestic market is understood to have occurred when: a) the reception of funds or resources is solicited, offered, or promoted from an indeterminate person or through the mass media, or b) funds or resources are obtained or solicited habitually or professionally; in both cases, through acts causing direct or contingent liability, with the intermediary being obliged to cover the principal and, if applicable, the accessories of the resources captured. Generally they are obtained through instruments such as checking accounts, savings accounts, fixed-term deposits, etc.

Círculo de Crédito Private company constituted as a credit information company, designed to integrate and provide information prior to the granting of credit and during the term of the financing

CNBVComisión Nacional Bancaria y de Valores

CO2 Carbon dioxide

CONDUSEF Comisión Nacional para la Protección y Defensa de los Usuarios de Servicios Financieros

CoverageProtection against the losses that may be incurred by a rise in prices, interest rates, or exchange rates

Coverage ratio Financial ratio obtained by dividing loan-loss reserves by the amount of the

loan portfolio. The higher it is, the better an institution is prepared to confront the expected losses of its loan portfolio.

Financial Inclusion Access to and use of a range of financial products and services, under appropriate regulation that looks after the interests of the system users and promotes their financial abilities

GRI Global Reporting Initiative

IPAB Instituto para la Protección al Ahorro Bancario

Loan portfolio Amount of credit granted by a financial institution

MIDE Museo Interactivo de Economía

SEP Secretaría de Educación Pública (the Mexican Ministry of Education)

SHCP Secretaría de Hacienda y Crédito Público (the Mexican Ministry of Finance)

SNEF Semana Nacional de Educación Financiera

SOFOM Sociedades Financieras de Objeto Múltiple

Sustainability Development which satisfies the needs of the present without endangering the ability of future generations to attend to their own needs